- Thoughtful Investing Newsletter

- Posts

- $NVDA Nvidia Stock Analysis: Is it a Good Investment Opportunity?

$NVDA Nvidia Stock Analysis: Is it a Good Investment Opportunity?

Business Model

NVIDIA Corporation operates in two segments:

Graphics

Compute & Networking

The Graphics segment includes sales of graphics processing units (GPUs) and other related products, while the Compute & Networking segment includes products related to data centers, artificial intelligence, and high-performance computing.

NVIDIA specialize in markets where their computing platforms can provide tremendous acceleration for applications.

Primary markets that NVIDIA serves:

Data Center

Gaming

Professional Visualization

Automotive

Track Record

NVIDIA massively outperformed the market in the last 5 and 10 years.

5 year total return of $NVDA vs $QQQ:

$NVDA = 37.70% annualized return

10 year total return of $NVDA vs $QQQ:

$NVDA = 56.31% annualized return

Stock price experienced massive drawdowns for the last 10 years:

$QQQ vs $NVDA drawdown comparison

Grew Revenue massively:

Grew EPS:

Grew Free Cash Flow and Free Cash Flow Per Share massively:

Good track record of beating EPS estimates:

Balance Sheet

Total assets is 2x of total liabilities:

It indicates that the company is in a strong financial position and is financially stable.

A lot of Total Current Assets relative to Total Current Liabilities:

Means the company has no liquidity issues in the short-term.

A good amount of Total Cash and Short Term Investments relative to Total Debt:

Majority of the Total Debt is Long Term Debt (payable beyond 12 months).

In short, the balance sheet of NVIDIA is healthy.

Competitive Advantages

1. Strong brand recognition: NVIDIA is a well-known brand in the gaming industry, and its GPUs are highly regarded by gamers and professionals alike.

2. Technological expertise: NVIDIA has a strong track record of innovation, with a focus on developing cutting-edge graphics technologies that deliver superior performance.

3. Diversified revenue streams: NVIDIA has a diversified revenue base, with its products and services spanning across gaming, data center, professional visualization, and automotive markets.

4. Strong financial position: NVIDIA has a strong balance sheet, with significant cash reserves and low debt levels, which provides the company with the financial flexibility to pursue growth opportunities.

Valuation

Price to Earnings (P/E) is at the highest using the data for the last 10 years:

For context, here’s the P/E (LTM) of NASDAQ 100:

And here’s the P/E of $NVDA and some of its competitors ($AMD $INTC $AAPL):

Price to Free Cash Flow (P/FCF) is at the highest using the data for the last 10 years:

Price to Free Cash Flow (P/FCF) of $NVDA compared to some of its competitors ($AMD $INTC $AAPL):

In summary, the current valuation of $NVDA is very high compared to its 10 year historical valuation and compared to its competitors based on P/E and P/FCF.

Forecast

Analysts are expecting the company to continue growing its revenue and EPS:

Reverse DCF

Using 10% Discount Rate and 2% Terminal Stage Growth Rate:

On the current share price, the market is expecting a 43.24% EPS growth rate.

On the current share price, the market is expecting a 44.40% Free Cash Flow growth rate.

Other Infos

Worldwide semiconductor sales is forecasted to keep on growing:

Nvidia is poised to benefit from major growth trends in the technology industry. Forecasts indicate that the global GPU market will see a compound annual growth rate (CAGR) of 21.2% until 2029:

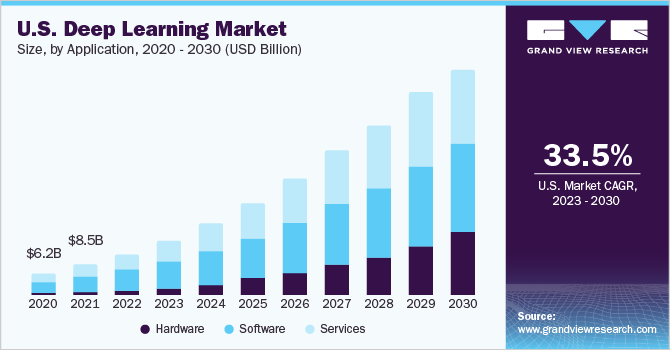

Similarly, the global deep learning market is projected to experience a CAGR of 33.5% through 2030:

And the global artificial intelligence market is predicted to have a CAGR of 38.1% until 2030:

These trends suggest a bright future for Nvidia as it continues to innovate and expand its offerings in these key areas.

Conclusion

Nvidia is a fantastic business with plenty of growth potential. My concern is the valuation since it’s priced at a very high P/E and P/FCF multiples. The expected EPS and FCF growth rate based on the reverse DCF calculation is very difficult to be met.

Buying shares of $NVDA at the current valuation is very risky. There's a significant possibility of multiple contraction, so there’s a huge downside risk. Having said that, the stock may continue to climb higher if the market continues to overlook the valuation (which is a big "if").

If the goal is to invest in Nvidia with a long-term investment time horizon, with a high probability to make money and with a margin of safety (minimal downside risk), it’s not an ideal option because it is too expensive.

When buying $NVDA today, it's crucial to time the market (be able to exit before the bubble pops) and practice risk management, such as limiting the position size in a portfolio.

I hope you enjoyed reading the latest newsletter issue! If you found it informative and valuable, please consider sharing it with your friends, family, and colleagues.

Sharing the newsletter is a great way to help spread the word and increase its readership. You can forward it via email, share it on social media, or simply tell others about it in person.

Thank you for your support, and I look forward to continuing to provide you with valuable content in the future.